Insurance fraud is a pervasive crime in society, and its occurrence is growing. In the United States in particular there are more and more cases of insurance fraud. It is a serious problem that, as discussed in our previous article, has a serious impact on business and citizens.

In this article we will be discussing the best ways to detect insurance fraud and avoid it. In other words, we will be looking at how to prevent insurance fraud. The most effective way to do this is, of course, by performing an insurance fraud investigation.

Insurance fraud costs businesses billions of dollars each year, so it would make sense that the demand for insurance fraud investigations would increase.

When do insruance fraud investigations come in?

In most cases, what would justify an insurance fraud investigator would be a suspected case of fraud. The PI would be brought in to find out if the insurance claim is fraudulent or not. These are often detected when insurance adjusters discover red flags when processing some kind of claim. Following that, they would go on to report these suspicious claims, which would then go over to the police. They would be notified that an insurance fraud investigation is about to take place, and then they would proceed.

As an insurance fraud investigation begins, the claimant’s background and credit must be checked. Furthermore, investigators will put them under surveillance. Through this process, they will collect evidence and any other relevant information. PIs would collect much of this data at the scene of an accident, for example. The scene of a claim can divulge plenty of details crucial to uncovering a crime, as can an individual or business’s books.

On most ocassions, this part of the investigation is enough to expose fraudulent activity.

Types of insurance fraud

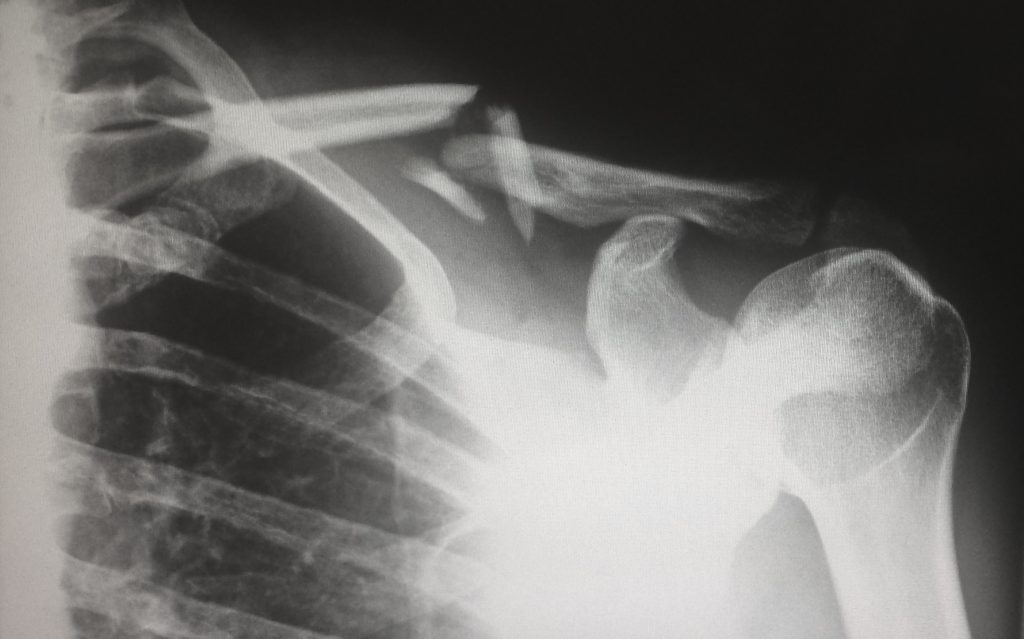

There are various ways in which people attempt to commit insurance fraud. Staged accidents and fake injuries at the workplace, for instance, are a rather common occurrence. Other examples include charging medical patients for testing that was never carried out. This is something that, unfortunately, occurs quite often in the medical profession. Whatever the type of fraud, however, investigators manage to close cases successfully. With insurance fraud, there is always a trail to follow, and private investigators are experts in sniffing these out.

Below is a list of some of the most common methods of insurance fraud:

- Billing fraud

- Libaility fraud

- Workers compensation fraud

- Auto-insurance fraud

- Life insurance fraud

- Healthcare insurance fraud

As we discussed in the previous article, insurance fraud is responsible for the raising of insurance premiums. It affects all of us, since we all need some kind of insurance. However, that’s not the only negative impact it can have. Fraudulent cases also have a direct effect on raising our taxes. Fortunately, the success of insurance fraud investigators helps to prevent many of these false claims from going through. Mitigating the negative impact on all of our lives.

If you find yourself in need of a licensed private investigator and their particular set of skills, please feel free to contact us. This link will get you in contact with one of our team members.