Insurance fraud is a costly and pervasive issue, affecting insurers and policyholders alike. From false claims to exaggerated damages, fraudulent activities undermine the integrity of the insurance industry, leading to increased premiums and financial losses. Private investigators (PIs) play a crucial role in combating insurance fraud, leveraging their expertise to uncover deceitful practices and provide the evidence needed for legal action. In this blog post, we explore the various methods PIs use to navigate insurance fraud and highlight the importance of their work in maintaining the trust and stability of the insurance sector.

Understanding Insurance Fraud

Insurance fraud occurs when individuals or entities deceive insurance companies to receive payouts they are not entitled to. Common types of insurance fraud include:

- False Claims: Submitting claims for incidents or damages that never occurred.

- Exaggerated Claims: Inflating the extent of damages or injuries to receive a higher payout.

- Staged Accidents: Orchestrating accidents or injuries to file fraudulent claims.

- Policyholder Fraud: Providing false information on insurance applications to secure lower premiums or better coverage.

- Agent and Broker Fraud: Involves unethical practices by insurance agents or brokers, such as pocketing premiums or falsifying documents.

The impact of insurance fraud is significant, leading to higher costs for insurers, increased premiums for honest policyholders, and strained resources for investigating legitimate claims.

The Role of Private Investigators in Insurance Fraud

Private investigators bring a wealth of skills and techniques to the fight against insurance fraud. Here are some key strategies they employ:

- Surveillance:

- Physical Surveillance: Monitoring claimants to verify the authenticity of their injuries or damages. For example, observing a person claiming disability benefits engaging in physical activities contradicting their reported condition.

- Digital Surveillance: Investigating social media profiles and online activities to gather evidence of fraudulent claims, for instance, finding posts or photos that show a claimant participating in activities inconsistent with their reported injuries.

- Background Checks:

- Criminal Records: Checking for previous convictions or patterns of fraudulent behavior.

- Financial Records: Reviewing financial histories to identify suspicious transactions or hidden assets.

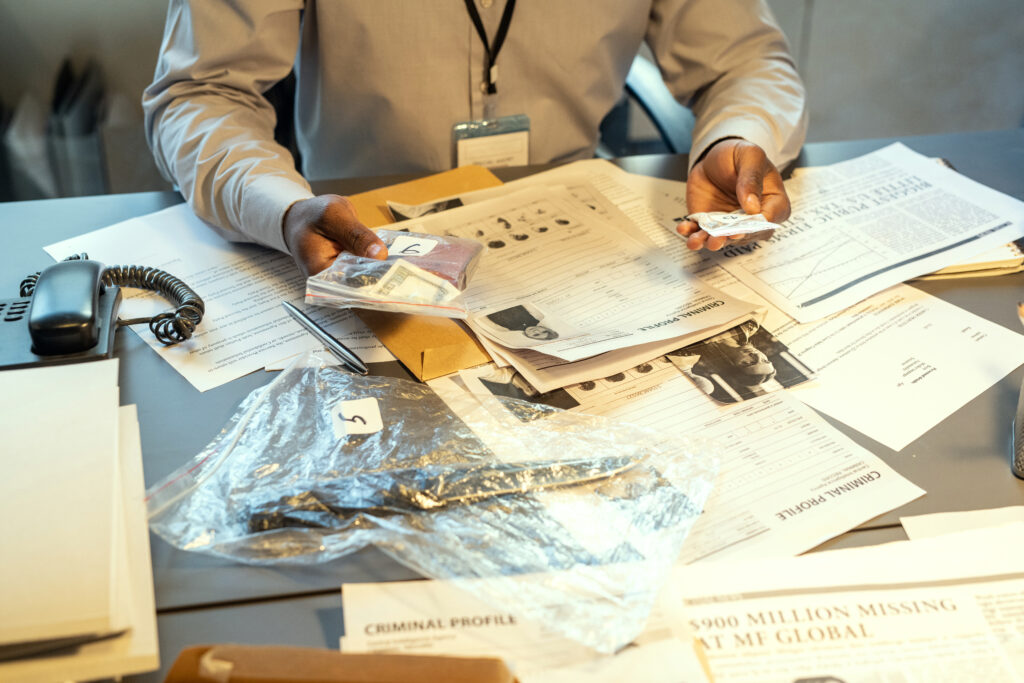

- Document Analysis:

- Claim Documentation: Scrutinizing claim forms, medical reports, and other supporting documents for inconsistencies or signs of falsification.

- Policy Reviews: Ensuring that the information provided during the application process is accurate and truthful.

- Interviews and Statements:

- Witness Interviews: Speaking with witnesses, colleagues, neighbors, and other relevant parties to gather information and verify the claimant’s story.

- Recorded Statements: Obtaining recorded statements from claimants and other involved parties to identify contradictions and gather additional evidence.

- Accident Reconstruction:

- Scene Investigation: Visiting the scene of the alleged accident to gather evidence, take photographs, and create diagrams that can help reconstruct the incident.

- Expert Analysis: Collaborating with forensic experts to analyze the evidence and determine whether the accident could have occurred as described.

Real-Life Impact: Case Studies

- Staged Accident Detection:

- A private investigator was hired to investigate a series of suspicious car accident claims. Through a combination of surveillance and accident reconstruction, the PI uncovered a network of individuals staging accidents to defraud insurance companies. The evidence gathered led to the arrest and prosecution of the fraudsters, saving the insurance company millions in fraudulent payouts.

- Exaggerated Injury Claims:

- In a workers’ compensation case, a claimant reported severe back injuries preventing them from working. The insurance company hired a PI to investigate. The PI conducted surveillance and found the claimant engaging in strenuous physical activities, including lifting heavy objects and participating in sports. The evidence collected led to the denial of the fraudulent claim and prevented further financial losses.

The Value of Private Investigators

Private investigators provide several key benefits in combating insurance fraud:

- Expertise: PIs possess specialized skills and knowledge that enable them to conduct thorough and effective investigations.

- Efficiency: PIs can quickly identify fraudulent activities and gather the necessary evidence, expediting the claims process.

- Cost Savings: By uncovering fraud, PIs help insurance companies avoid paying out fraudulent claims, leading to significant cost savings.

- Legal Support: The evidence collected by PIs is often crucial in legal proceedings, providing the necessary support for denying fraudulent claims and prosecuting fraudsters.

Insurance fraud remains a significant challenge for the insurance industry, driving up costs and undermining the trust between insurers and policyholders. The expertise and dedication of private investigators are invaluable in combating this issue, as they employ a range of sophisticated techniques to detect and document fraudulent activities. By leveraging the skills of PIs, insurance companies can protect their financial stability, ensure fair treatment of policyholders, and uphold the integrity of the insurance process. As fraudsters become increasingly cunning, the role of private investigators will only become more critical in maintaining the trust and stability of the insurance sector.